I created a free Personal Financial Tracker template in Google Sheets to help you stay on top of your finances.

Here is what it does and its benefits.

Managing your personal finances doesn’t have to be a daunting task. Whether you are trying to pay off debt, save for a dream vacation, or simply want to know exactly where your hard-earned money is going each month, having the right system in place is the secret to success.

That is exactly why I designed this easy-to-use Finance Tracking System in Google Sheets. It gives you a clear picture of your financial health without the need for expensive software or complex accounting skills.

What This Spreadsheet Does

This financial tracker is broken down into five easy-to-navigate tabs, each serving a specific purpose in your financial journey:

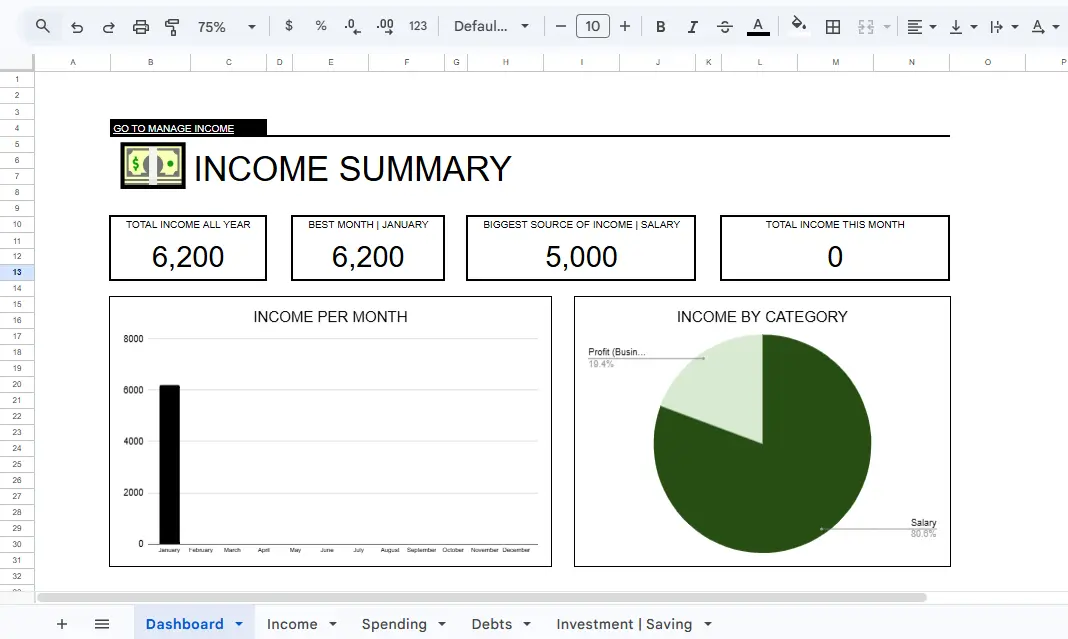

The Master Dashboard: The dashboard automatically pulls data from the other tabs to give you an at-a-glance summary of your entire financial situation.

You will instantly see your total income for the year, your best-performing income months, and your biggest income sources.

It also highlights your total spending, your highest spending month, and where most of your money goes (like bills).

Furthermore, you can quickly review your total debts, how much you have paid off, and your overall savings and investments progress.

Income Tracker: The Income tab allows you to record every dollar that comes in.

You can categorize your earnings into groups such as Salary, Side Hustle, Gifts, Bonus, Dividends, Profit (Business), or Other.

It automatically calculates your monthly income and compares it directly against your spending so you always know your true balance.

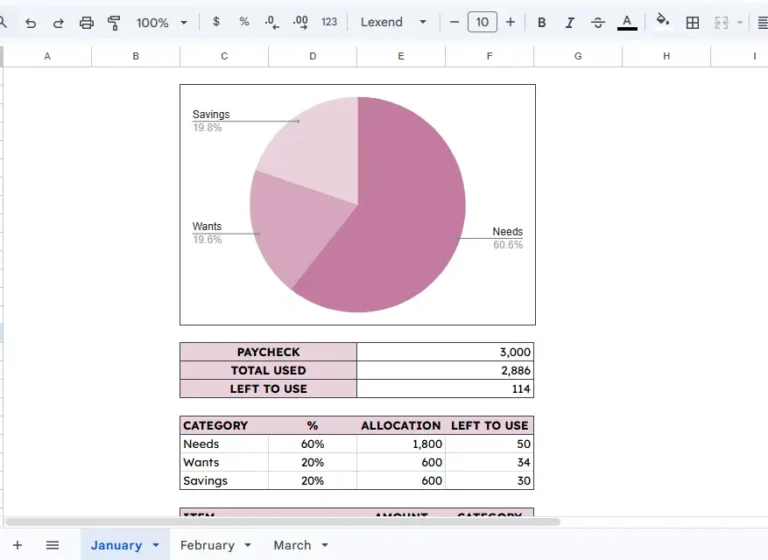

Spending Tracker: Stop wondering where your money went. The Spending tab lets you log all your expenses.

You can categorize them into Bills, Expenses, Subscriptions, and Others.

The sheet automatically aggregates your spending by month and category, and even allows you to isolate and review specific months to see exactly what drained your wallet.

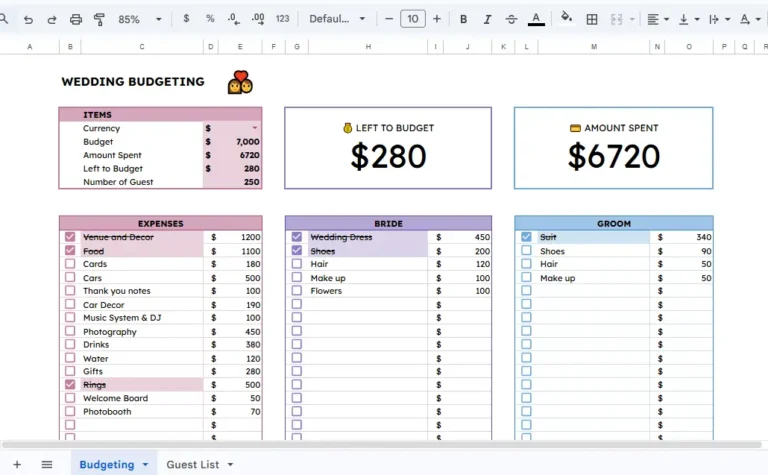

Debts Manager: Debt can be overwhelming, but tracking it brings clarity.

The Debts tab separates your liabilities into paid and unpaid categories.

You can track different types of debts, including Loans, Personal, Credit Cards, Student Loans, and Mortgages.

Seeing the total amount of debts paid grow is incredibly motivating!

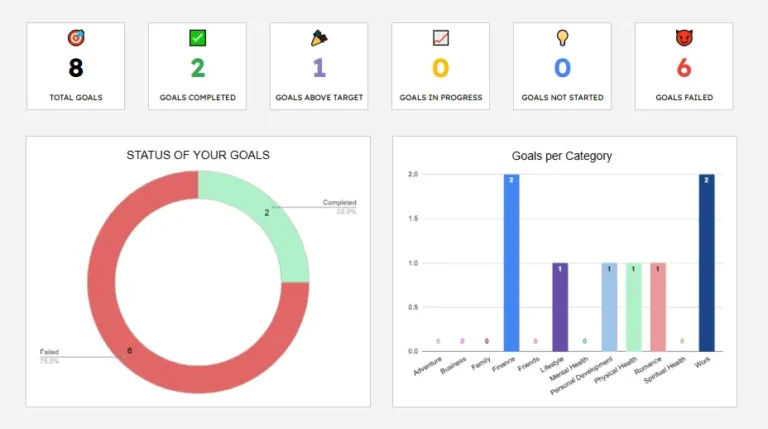

Savings & Investments: Watch your wealth grow in the Savings and Investments tab.

Log your contributions to your Savings Accounts, Retirement Accounts, Stocks, Real Estate, and Startups.

It tracks your progress month by month, helping you stay committed to your future financial goals.

How to Use the Spreadsheet

Using this template is incredibly straightforward:

Navigate the Interface: Start by familiarizing yourself with the main sections: Dashboard, Income, Spending, Debts, and Investment | Saving.

Enter Your Data: Go to the Income, Spending, Debts, and Investment areas. Only enter your numbers into the designated entry tables, which are clearly labeled with instructions like “ENTER YOUR INCOME IN THIS TABLE ONLY”.

Let the Sheet Do the Work: Do not type anything into the Dashboard or the summary tables. These are entirely automated and will update magically as you log your daily or monthly transactions.

Review and Adjust: At the end of every month, check your Dashboard to see if you stayed within your budget, and adjust your habits for the next month accordingly.

How to Make Your Own Copy

Since this is a shared template, you won’t be able to edit the original version directly.

To start using it for yourself, follow these simple steps:

- Open the provided spreadsheet link.

- Click on “File” in the top left corner of the Google Sheets menu.

- Select “Make a copy” from the dropdown menu.

- Name the file whatever you like, choose a folder in your own Google Drive, and click “Make a copy.” You now have your very own private version to edit and use!

The Benefits of Using This Tracker

Complete Financial Clarity: It eliminates financial anxiety by showing you exactly what you earn, spend, owe, and save.

Highly Customizable: Since it is built in Google Sheets, you can easily tweak categories to perfectly match your unique lifestyle.

Cloud-Based Accessibility: You can update your budget from your laptop at home or from your phone while you are out shopping.

Automated Calculations: You don’t need to be a math whiz. The built-in formulas do the heavy lifting, preventing human error.

Goal-Oriented: By tracking your debt payoff and savings growth visually, you stay motivated to reach your financial milestones faster.

Take control of your money today. Grab your copy of the tracker, start inputting your numbers, and watch your financial life transform