I have made a free Excel Net Worth Tracker to help you track your Net Worth.

Tracking your net worth using an Excel tracker is a powerful habit that can significantly improve your financial well-being.

It helps you take control of your finances, identify opportunities for growth, and make better decisions.

Here’s a detailed look at the benefits of using a net worth tracker and actionable steps you can take to grow your net worth over time.

Benefits of Tracking Your Net Worth

1. Clarity and Awareness

An Excel tracker gives you a clear snapshot of your financial position at any given time.

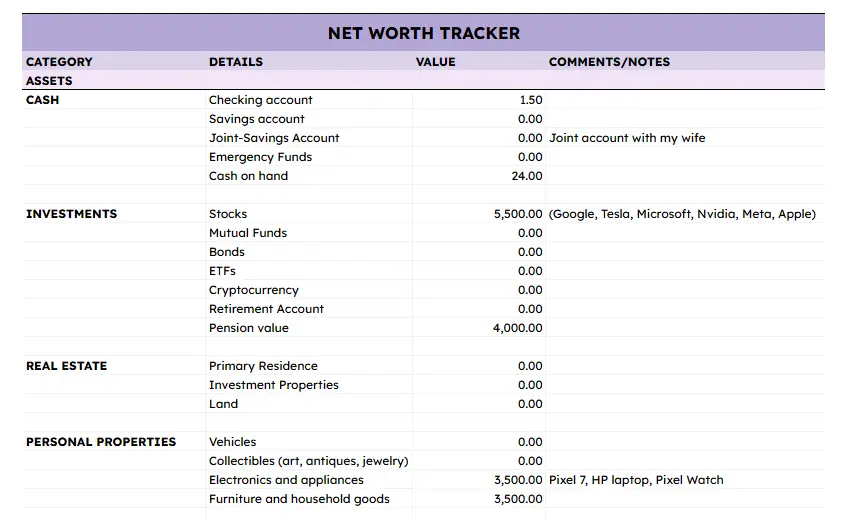

It lists all your assets such as cash, investments, real estate, and personal properties and subtracts liabilities (if included) to determine your total net worth.

This clarity allows you to see exactly where you stand, helping you avoid financial denial or guesswork.

2. Helps You Identify Spending and Saving Patterns

By consistently updating your net worth tracker, you’ll begin to notice trends. Are your investments growing?

Are you saving enough cash for emergencies? Are there areas where you might be overspending or holding onto depreciating assets?

Having this data lets you pivot your financial strategy with confidence.

3. Motivation and Accountability

Seeing your net worth increase even by small amounts can be incredibly motivating.

On the other hand, if your net worth is decreasing, it prompts you to take action.

Tracking progress over months or years keeps you accountable to your goals, whether that’s saving for a house, paying off debt, or building retirement wealth.

4. Informed Decision-Making

Whether you’re considering making a large purchase, changing jobs, or investing in a new opportunity, having a net worth tracker helps you understand the impact of your decisions.

You can evaluate whether you’re in a strong financial position or need to hold back and save more.

5. Customizable and Simple

Using Excel means you can fully customize your tracker to reflect your personal financial situation.

You can add or remove categories, track growth month over month, and include notes or goals.

How to Increase Your Net Worth

Increasing your net worth involves a combination of boosting your assets and reducing your liabilities. Here are some proven strategies:

1. Increase Your Income

Look for ways to increase your income. This could mean negotiating a raise, switching to a higher-paying job, starting a side hustle, or monetizing a skill online.

Every extra dollar earned and saved adds to your net worth.

2. Invest Consistently

As shown in the tracker, investments like stocks can significantly grow your net worth over time. Even if you start small, consistency matters.

Diversify your investments to reduce risk and consider setting up automatic monthly contributions to your investment accounts.

3. Build an Emergency Fund

Having emergency savings ensures you won’t need to dip into investments or take on high-interest debt when unexpected expenses arise.

A good rule of thumb is to save 3–6 months’ worth of living expenses.

4. Cut Unnecessary Expenses

Review your expenses and look for areas to cut back. Small changes like canceling unused subscriptions, eating out less, or buying second-hand can make a big difference when compounded over time.

5. Avoid Bad Debt

High-interest debt like credit card balances can erode your net worth quickly.

Prioritize paying off these debts as soon as possible. Use tools like the debt snowball or avalanche method to stay organized and efficient.

6. Increase the Value of Existing Assets

You can also boost your net worth by improving or optimizing current assets.

For example, maintaining electronics and furniture well extends their useful life. Renting out a spare room or selling unused items can also unlock hidden value.

7. Educate Yourself

Financial literacy is a powerful tool. The more you learn about money management, investing, taxes, and budgeting, the more confident and successful you’ll be in growing your net worth.

Using a simple Excel net worth tracker can help you stay organized, focused, and empowered financially.

It gives you a visual representation of your progress and serves as a motivational tool.

Combine this with smart financial habits, like investing, budgeting, and continuous learning, and you’ll be well on your way to growing a healthy and sustainable net worth.