Take Control with a Simple Rule

I made a free 50/30/20 Budgeting template to help you stay in control of your finances. If you’re tired of messy budgets or not knowing where your money goes, this method gives you a clear structure to follow.

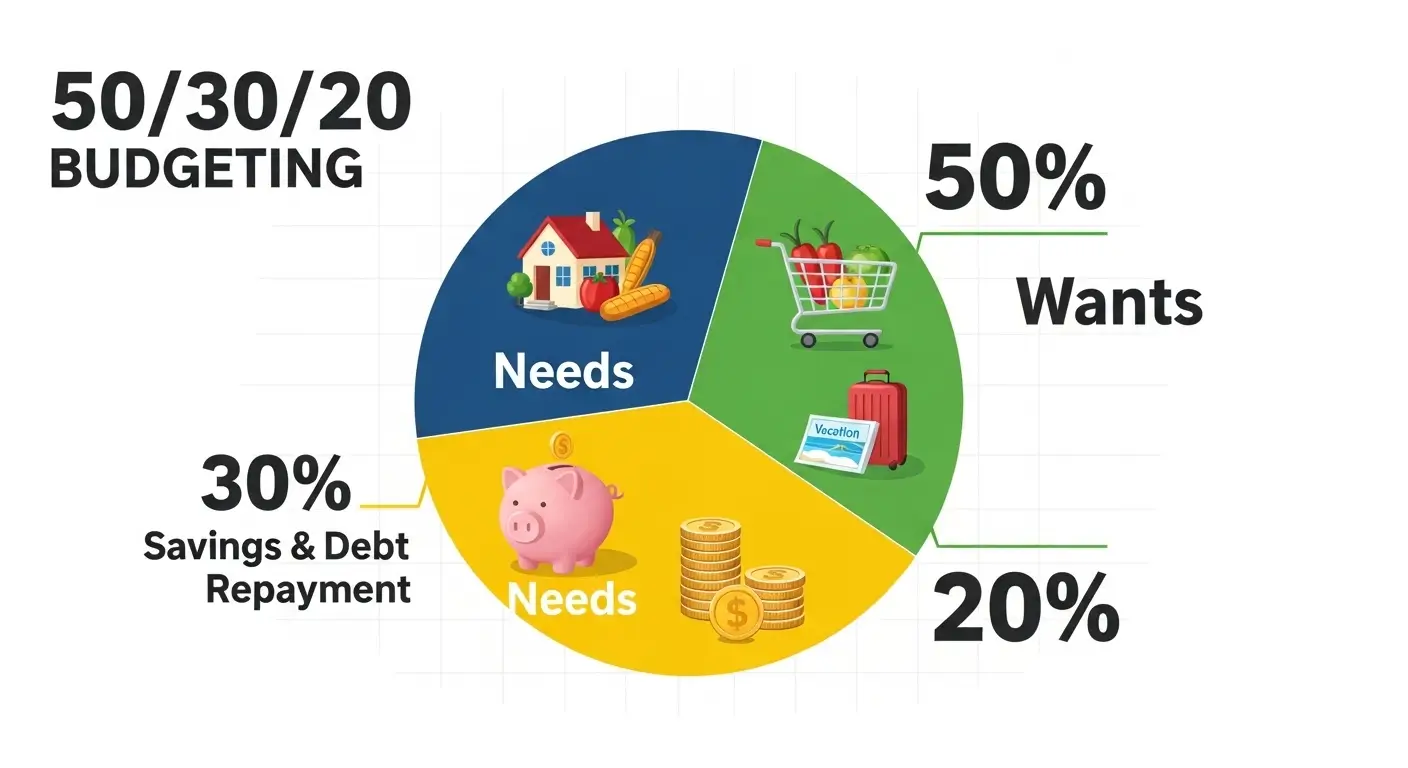

The idea is to divide your after-tax income into just three buckets, 50% for needs, 30% for wants, and 20% for savings.

It’s a popular framework credited to Senator Elizabeth Warren. I’ve built it into a Google Sheet so you can apply the rule and see how your year shapes up.

How the 50/30/20 Rule Works

50%

Needs

Essential expenses like rent, utilities, groceries, insurance, and minimum debt payments. These are the costs to maintain your daily life.

30%

Wants

Discretionary spending that makes life enjoyable. Think dining out, subscriptions, entertainment, travel, and hobbies.

20%

Savings & Debt

This bucket is for your future. Emergency savings, retirement, investments, and paying down debt above the minimum.

Key Benefits

Simplicity

No need for dozens of categories. Just assign your net income into three broad buckets and avoid constant micromanaging.

Balance

The rule forces you to balance covering needs, enjoying life, and securing your financial future without neglecting any single area.

Better Awareness & Discipline

Become more conscious of where your money goes. This awareness helps you make better choices and identify where your “needs” may be creeping too high.

Flexibility

The 50/30/20 rule is not rigid. If your situation demands it (like high rent or aggressive debt paydown), you can easily tweak the percentages.

Long-Term Focus

Savings and debt repayment are baked in from the start, helping you build momentum toward financial goals rather than leaving them as an afterthought.

How to Use the Template

- Enter your monthly after-tax (net) income.

- Fill in your actual expenses in each “needs” and “wants” line item on the monthly tab.

- Let the spreadsheet do the math — it shows you how much is left or over in each bucket.

- Watch your Dashboard to see how each month stacks up over the year for a quick visual check.

- Adjust as necessary. If “needs” exceed 50%, you may need to cut wants or temporarily shift priorities.

Final Thoughts

The 50/30/20 rule isn’t magic, it’s a guideline. It gives you a clear, manageable starting point. If you need to deviate (e.g., 55/25/20), that’s okay.

The value lies in having structure. Our Google Sheets template gives you the perfect place to experiment, track, and refine your budget.